Information is power and so is entertainment. With Trump now threatening tariffs on films, an Airbus of streaming might have wings.

Germany’s Chancellor-in-waiting Friedrich Merz is heading for Paris this week at a time when French President Emmanuel Macron wants to rekindle European integration in the face of Trumpian chaos. And one small item in the policy program hammered out by Merz’s coalition government might give Macron reason to perk up: “We support the establishment of a European media platform.”

European media platforms already exist, in a way: They’re called Netflix Inc., Walt Disney Co. and Apple Inc. Their deep pockets and global reach have made them the go-to place for continental content from Emily in Paris to Banijay Group NV’s show about the great chef Antonin Careme. With nascent European rivals struggling in the streaming wars — recent casualties include France’s Salto and Italy’s government-funded ITsART — politicians like Macron have been instead pushing US platforms to fund more local content.

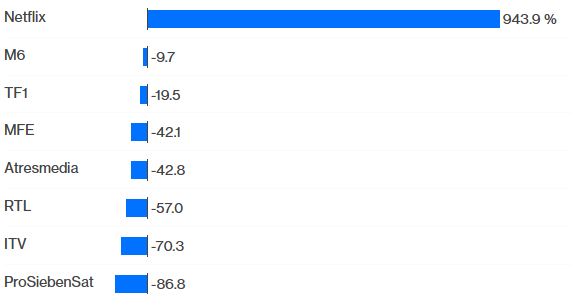

A lost tv decade

Share-price performance since 2016 shows Netflix beating broadcasters

Source: Bloomberg

If Merz is ready to heed Macron’s call for more ambitious action, it suggests US President Donald Trump’s trade war has really raised the stakes — especially now with threats of 100% tariffs on films produced overseas. Information is power and so is entertainment: Many Germans woke up to that when Elon Musk endorsed far-right party AfD and interviewed its head on his social network X, where he has more followers than the population of France and Germany combined. Now France is bracing for a direct attack on aforementioned local-content rules as part of American arm-twisting over trade tariffs. If Europeans are serious about defending democratic and cultural values — and Merz’s government suggests they are — an Airbus of streaming might help.

What might such a project look like? Macron and Merz cite the need to boost Franco-German broadcaster ARTE — launched by their predecessors Francois Mitterrand and Helmut Kohl. While usually associated with high-brow content like opera, the station has proven able to draw millions of views with heavy-metal concerts online. Beyond culture, the platform could also be a useful geopolitical hedge if tariff talks turn sour.

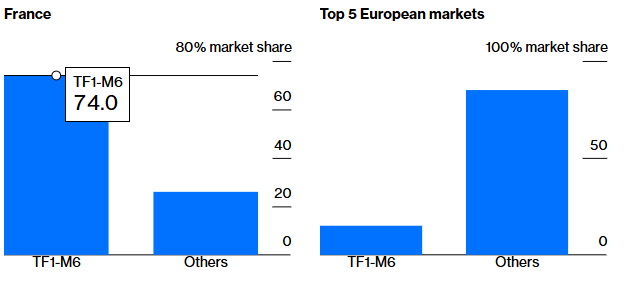

Yet there would also be value in using it to send a broader industry signal in favor of more consolidation. European broadcasters look like a collection of Asterix villages, fragmented along national borders and slow to adapt to technological disruption, yet competition regulators continue to show hostility to building champions. In 2022, Macron’s dream of a TF1-M6 merger to counter Big Tech was blocked, given it would have controlled 70% of the national TV advertising market. The flip side is that local companies’ spending on content in France has stayed around €6.2 billion ($7 billion) since 2016, while the US streaming giants have increased spending on top European markets by 26 times to €11.6 billion, according to Ampere Analysis.

Too big to merge

A French TV tie-up of TF1 and M6 would impact the ad market at home

Source: Ampere Analysis

Antitrust concerns won’t go away overnight, yet geopolitics will add new impetus to shifting the debate or finding new ways to team up. Media analyst Ian Whittaker points to RTL Group SA as one example: In 2024, the Luxembourg-based firm announced an advertising-technology partnership with ProSiebenSat.1 Media SE to make German advertising and the companies themselves less dependent on US tech. On the content side, recent deal activity includes the Berlusconi family’s MediaForEurope NV takeover offer for ProSiebenSat.1, valuing it at around €1.3 billion.

The real question, as in many industries from banking to defense, is just how committed Europeans themselves are to overcoming national borders. Bloomberg Intelligence analyst Tom Ward still sees obstacles from regulation to language barriers and consumer tastes. There was a revealing moment in Macron’s comments to Variety magazine last year when, having called for a European Netflix, he promised to “fight hard” to keep Emily in Paris from moving to Rome. The national interest dies hard: Even if artificial intelligence manages to help French viewers understand the Portuguese and vice versa, it won’t suddenly unify different legal, regulatory or political systems that favor their own media moguls. America’s hegemonic power has been driven by having one currency, one national audience and one language — and one capital market willing to spread the Netflix wealth.

The odds are long, therefore, on a true Netflix slayer emerging from the trade war. But perhaps like the great auteurs of European cinema, maybe the opportunity comes from experimentation. That could include an Airbus-style project centered around ARTE and an encouragement of more private-sector partnerships. The democratic, cultural and corporate damage of sitting back and doing nothing could be big: In the 20 years since YouTube was launched, online advertising has ballooned 38-fold to become a $722 billion market, while TV has grown about 25%. Emily may still be in Paris, but Macron is probably more excited about what Friedrich can bring when he visits.

Also read: Trump orders 100% tariff on foreign-made movies to “save” Hollywood

Source: Lionel Laurent – Bloomberg